Companion Animal Network Australia (Australia CAN) is calling for banks to do more to protect the public following a growth in pet scams.

According to the ACCC’s July 2022 Scamwatch report, pet scams increased by 48 per cent in 2021, receiving 3,332 pet scam reports and resulting in losses of over $4 million.

Trish Ennis, CEO of Australia CAN, said with scammers continually developing new ways to fool people, pet lovers need to increase their vigilance in checking for those little clues that can alert them that something is a scam.

“Banks can also do more to help protect the public as hundreds of bank accounts are reportedly being used for pet scam-related activities.

“Scammers are professional crooks, and it can be difficult to distinguish between what is real or a scam. We encourage pet lovers to learn how to spot a puppy scam and avoid the heartbreak, loss of money and in some cases, potentially having to surrender their pet to the shelter.”

Australia CAN has partnered with the ACCC and Puppy Scam Awareness Australia (PSAA) to help animal lovers identify and avoid pet scams.

“Pet scammers will generally advertise on fake websites, social media, or classified sites. Scammers may also act as a rescue group.

“People won’t be able to see the pet and after it’s paid for, victims will be asked for more money because of a range of issues involving transport, illness or need for vaccines. Scammers go to a lot of effort to convince people that the pet is being delivered,” explained Ennis.

PSAA is a dedicated organisation, founded by Sandy Trujillo, that brings awareness about the thousands of pet scamming syndicates that prey on pet shoppers by helping potential owners spot a scammer and assist those who have been scammed.

“We work hard reporting and negating scams daily to actively protect Australians from scams. We don’t just report scammers, we shut down their online presence immediately, and help victims try and get their money back,” said Trujillo.

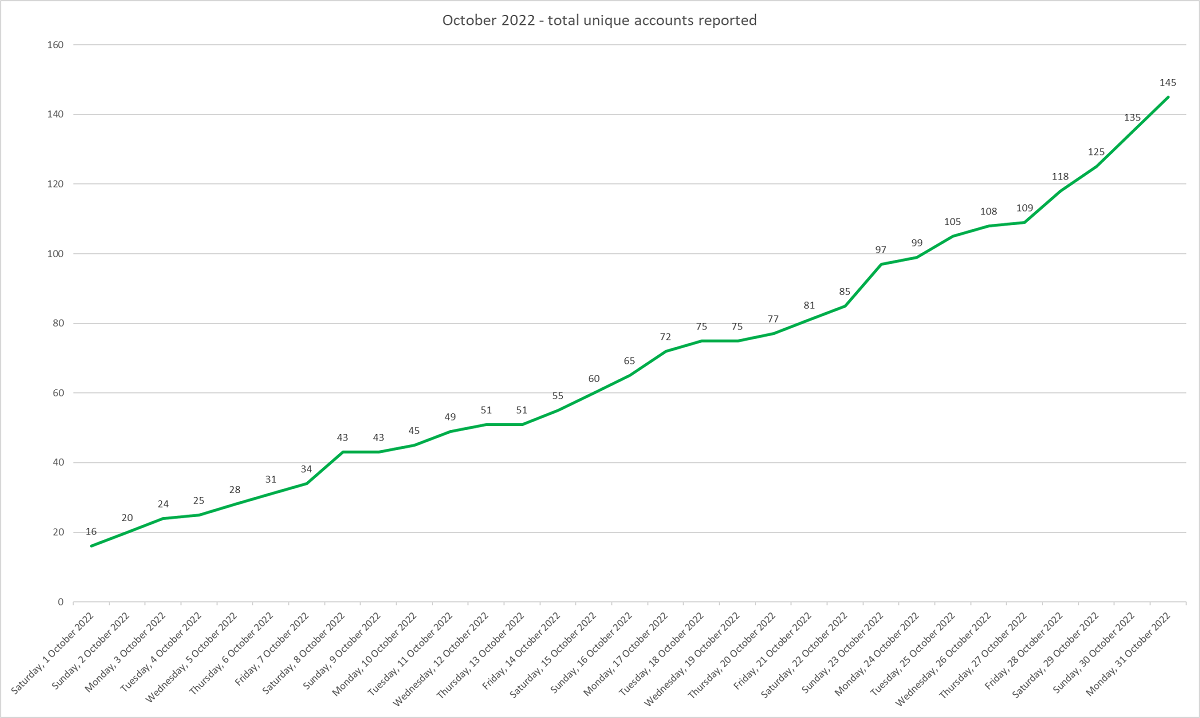

Partnering with Meta, PSAA is collaborating on ideas of how to combat scams on social media, and since 2021 over 600 Australian fraudulent bank accounts, 3000 websites, 5000 social media pages and profiles have been reported to PSAA.

Despite their best efforts, PSAA often runs into trouble when trying to deal with banks. As was evident on 3 October when PSAA reported an account to a major bank with evidence that the account was being used for fraudulent activity. The same account was reported, with more evidence, three days later, but on 11 October a victim ‘Sharon’ was scammed from the account.

“Every turn that ‘Sharon’ has tried to take has been met by the bank with rudeness, denial, and obstruction. They refuse to accept the evidence provided. Her contact with the Australian Financial Complaints Authority have also been fruitless with them stating that due to the amount she has lost they are not interested.

“Educating the public of the dangers and more importantly supporting and guiding victims through this traumatic event has been priority,” said Trujillo.

Launching a Breeders and Pet Transport Directory, PSAA is hoping to help validate and protect businesses from scammers stealing their intellectual property.

“Most breeders are now dubious of strangers coming over and stealing their pups. This has also become a thing during Covid. Many choose to speak on the phone or do Facetime. It’s not always possible to find a breeder in your state too. Victorian laws are regulated so heavily that Victorian’s are choosing to buy interstate. That’s how most get caught in scams.”

To stay up to date on the latest industry headlines, sign up to the Pet Industry News e-newsletter.